- 1 Circular No. 21/2004/TT-BTC of the Ministry of Finance,

- 2 Circular No. 29/2004/TT-BTC of April 6, 2004 guiding the issuance under-writing and issuance agency for Government bonds, Government-underwritten bonds and local administrations' bonds

- 3 Decision No. 66/2004/QD-BTC of August 11, 2004, promulgating the guiding regulation on order and procedures for issuing Government Bonds, Government-underwritten Bonds and Local Administrations’ Bonds.

- 4 Circular No. 27/2010/TT-BTC of February 26, 2010, prescribing rates and the collection, remittance, management and use of charges for securities operations to be applied at the Stock exchanges and the Vietnam Securities Depository Center

- 1 Law No.01/2002/QH11 of December 16, 2002 state budget Law

- 2 Law No.70/2006/QH11 of June 29, 2006 on securities

- 3 Decree No. 118/2008/ND-CP of November 27, 2008, defining the functions, tasks, powers and organizational structure of the Ministry of Finance.

- 4 Law No. 29/2009/QH12 of June 17, 2009, on public debt management

- 5 Law No. 62/2010/QH12 of November 24, 2010, amending, supplementing a number of articles of Law on Securities

| MINISTRY OF FINANCE | SOCIALIST REPUBLIC OF VIET NAM |

| No.: 17/2012/TT-BTC | Ha Noi, February 08, 2012 |

GUIDELINES ON ISSUANCE OF GOVERNMENT BONDS IN DOMESTIC MARKET

Pursuant to the Law on Public Debt Management No.29/2009/QH12 dated June17, 2009;

Pursuant to the Securities Law No. 70/2006/QH11 dated June 29, 2006 and the Law amending and supplementing a number of articles of the Securities Law No. 62/2010/QH12 dated November 24, 2010;

Pursuant to the Law on State Budget No. 01/2002/QH11 dated December 16, 2002;

Pursuant to Decree No. 118/2008/ND-CP dated November 27, 2008 stipulating functions, tasks, powers and organizational structure of the Ministry of Finance;

Pursuant to Decree No. 01/2011/ND-CP dated January 05, 2011 on the issuance of Government bonds, Government-guaranteed bonds and bonds guaranteed local authority bonds;

The Ministry of Finance guides the issuance of Government bonds in the domestic market as follows:

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

2. Process and procedures for re-acquisition or swap of bonds, modification of registration, deposit, listing of reacquired or swapped bonds shall comply with other written guidance of the Ministry of Finance.

In addition to the terms explained in Decree No. 01/2011/ND-CP, in this Circular, the following terms shall be construed as:

1. “Bonds initially issued” are the new bonds first issued on the primary market.

2.” Additional bond” are the bonds issued addtionally for a class of bond in circulation with nominal interest rate and the same maturity date with outstanding bonds.

3. ‘’ Bond issuance date” is the effective date of the bonds and is the time as the ground for determination of payment of principal and interest of the bonds.

4. “Date of bond issuance organization” is the date to organize bid bond for bonds issued by the bidding method and the day when the State Treasury signs the bond underwriting contract for the bonds issued in the form of underwriting.

5. ” Date of bond payment " is the date the bond buyer makes payment of bonds to the issuer.

6. “Nominal interest rate of bond” is the percentage (%) of annual interest on the face value of bonds which the issuer has to pay to the bond holder on any interest payment term under the conditions and terms of the bond.

7. "Interest rate of bond issuance” is interest rate of bid winning coupon rate is the interest rate of underwriting decided by the Ministry of Finance on the basis of the bidding results, bond issuance underwriting, or the interest rate announced by the Ministry of Finance in the case of issuance through agent and retail sales through the State Treasury.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

9. "Issuance at par" means the bonds issued at a price equal to the par value of bonds.

10. “ Issuance below par” means the bonds issued at a price lower than the par value of bonds

11. “ “ Issuance above par” means the bonds issued at a price higher than the face value of bonds

12. "Single price bid" is the method to determine the results of bid by which the interest rate level of bond issuance is the highest bid-winning interest rate and applies equally to the winning members.

13. "Multi price bid" is the method to determine the results of bid by which the interest rate level of bond issuance for each winning member is equal to the bidding interest rate of that member.

14. "Final registration day of bond" means the date the Vietnam Securities Depository identifies the list of bid owners to pay interest and principal of bonds.

15. “Cum right date” is the days in the period from the preceding interest payment date to the final registration day of the bond.

16. “ Ex right date: is the days in the period from the final registration day of the bond to the preceding interest payment date of the bond.

1. The bond issuer os the Ministry of Finance.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

In addition to the terms and conditions of thebond specified in Article 6 of Decree No. 01/2011/ND-CP, the Ministry of Finance shall make specific guidance on the terms and conditions of the bond as follows:

1. Term

a) Treasury bills with the term of 13 weeks, 26 weeks and 52 weeks;

b) Treasury bond and national construction bond with the term of 2 years, 3 years, 5 years, 10 years, 15 years and 30 years.

c) The Ministry of Finance shall stipulate other terms of bond in several necessary cases.

2. Face value

a) The bonds have a face value of one hundred thousand (100,000) dong. Other nominal values are multiples of one hundred thousand (100,000) dong.

b) The Ministry of Finance shall specify the face value of foreign currency denominated bond for each issuance of foreign currency bond issued under the scheme of issuance of foreign currency bond was approved by the Prime Minister.

3. Form

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

b) Bonds issued by the method of issuance and retailing agent are issued in the form of certificates, book entry or electronic data.

4. Method of issuance

a) Bonds issued by the bidding and underwriting method are issued at par, below par or above par.

b) Bonds issued by the method of issuance and retailing agent are issued at par.

5. Nominal interest rate of bonds.

a) The nominal interest rate of bonds may be the fixed-rate or floating rate as decided by the Ministry of Finance;

b) In case the nominal interest rate of bonds is the floating interest rate, the Ministry of Finance shall stipulate the reference interest rate level and announce it for each issuance.

6. Payment of interest and capital of bond

a) For bonds issued by the bidding and underwriting method, the bond dividend shall be paid once after every six (6) months or twelve (12) months from the date of issuance of bonds and the principal is paid once on bond maturity;

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

c) The State Treasury shall announce the time to pay interest and principal of bonds at the time of issuance.

7. Time for additional issuance of bonds

Additional bonds are issued within two (02) years from the date of bond issuance in case the bonds have fixed nominal interest rate with the remaining term of one (01) year or more.

1. The Ministry of Finance stipulates the interest rate of bond issuance in each period or each issuance.

2. Based on the frame of interest rate specified in Clause 1 of this Article, the State Treasury shall select and decide the interest rate of bond issuance for each issuance.

Article 6. Making and announcing the plan for bond issuance

1. Every year, based on the indicator of capital mobilization for the state budget and for development investment approved by the National Assembly, the Ministry of Finance shall make and announce the plan for bond issuance for the year and plan for mobilization for each quarter.

2. The plan for quarterly and monthly bond issuance shall be announced on the website of the Ministry of Finance, State Treasury and Hanoi Stock Exchange.

1. Based on the plan for bond issuance announced, the State Treasury shall organize the bond issuance under the provisions of this Circular and the relevant laws.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

3. For issuance of national construction bond, the Ministry of Finance shall develop the Scheme for submission to the Prime Minister before implementation. The scheme of issuance includes the following basic contents:

a) The purpose of issuance of national construction bond;

b) The terms and conditions of national construction bond: amount, form, term, currency, interest rate, issuance time and method of interest and principal of bonds.

c) The buyers;

d) The plan for orgnization of issuance

4. For bonds issued under the retail method through the State Treasury system or issuance agent, the State Treasury plans release, the Ministry of Finance for approval before implementation.

1. Date of issuance

a) Date of bond issuance by the bidding method and the underwriting is the fifteenth (15th) and the last date of each month. For February is the fifteenth (15th) and twenty-eighth (28th).

b) For bonds issued by the retail method through the system of State Treasury or agent, the Ministry of Finance shall regulate the issuance frame of each issuance.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

a) Date of issuance organization for bonds issued by the bidding and underwriting method is two (02) business days prior to the date of bond issuance specified at Point a, Clause 1 of this Article.

b) In several cases, the Ministry of Finance shall make a decision on the date of bond issuance organization different from the provisions specified at Point a, Clause 2 of this Article.

3. Date of bond payment

a) Date of bond payment issued by the bidding and underwriting method is two (02) business days after the date of bond issuance organization.

b) Date of bond payment issued by the method of issuance and retail agent through the State Treasury system is the date the investors purchases bonds at the issuance agent or the State Treasury.

4. Based on the provisions of Clause 1, 2 and 3 of this Article, the Ministry of Finance shall announce the schedule of bond issuance by the bidding and underwriting method in the following year on its website, of the State Treasury and Hanoi Stock Exchange.

5. For bonds issued by the method of agent and retail through the State Treasury system, based on the plan for bond issuance by each issue decided by the Ministry of Finance, the State Treasury shall announce the issuance date and organize the implementation of provisions in this Circular.

1. Based on the standards and conditions specified in this Chapter, the Ministry of Finance shall select and announce the list of member participating in bond issuance bidding (hereafter referred to as bidding members) in each period.

2. The Vietnam Social Insurance is recognized as bidding member and may only participate in non-competitive bid of interest rate in the sessions of government bond issuance by the bidding method. Vietnam Social Insurance has not to comply with the provisions on the rights and obligations of the bidding members bidding specified in Article 10 of this Circular.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

a) As the only subject involved in the sessions of government bond and government-guaranteed bond issuance b the bidding method.

b) Being selected with priority by the State Treasury as the main underwriter for bond issuance by the underwriting method if meeting the criteria and conditions stipulated in Article 21 of this Circular;

c) Being selected with priority by the State Treasury as the agent for bond issuance by the agent method

d) Being entitled to periodic exchange with the Ministry of Finance on the bond issuance and direction of bond market development policies.

2. Obligations

a) Registering to buy government bonds in all sessions of issuance with reasonably registered interest rate level.

b) Buying bonds annually with a minimum amount prescribed by the Ministry of Finance from time to time, in accordance with the stages of market development;

c) Making full and timely payment of bonds purchased from bid winning or underwriting receiving.

d) Announcing the reference price of of selling and buying offer in specialized government bond market as prescribed by Hanoi Stock Exchange.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

g) Within seven (07) business days after the end of the quarter, making a report to the Ministry of Finance on operation evaluation of the bond market in the preceding quarter and forecasting demand for bond investment, money market liquidity and currency and interest rate expectation in the next quarter;

h) Promptly making report to the Ministry of Finance on the changes in the business license (including merger, split, bankruptcy, withdrawal of business license), the special control of the State authorities over the business activities (if incurred) and the conclusion of the State authorities on violations of the law of the unit (if incurred). The time limit for report to the Ministry of Finance Ministry is within ten (10) business days since the emergence of the above events;

i) Complying with other obligations as prescribed in this Circular.

1. Being commercial banks, finance companies, securities companies, insurance companies, investment funds and other financial institutions established and operating legally in Vietnam;

2. Having contributed charter capital at least equal to the legal capital of the relevant laws.

3. Meeting the capital adequacy ratio in accordance with the relevant laws;

4. Having the time of operation of at least 03 years;

5. Being a member of the specialized government bond market at Hanoi Stock Exchange.

1. Record for becoming bidding member includes:

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

b) Notarized business License;

c) Audited financial statements of the last three (03) years;

d) Quarterly financial statements as of the latest date upon request;

e) Report on the participation in the bond market in the last year under the reporting forms specified in Appendix 2 of this Circular;

g) Notarized copy of recognition document of specialized government bond market at Hanoi Stock Exchange;

h) Documents proving the satisfaction of capital adequacy ratio prescribed by law.

2. Process and procedures for recognition of bidding members

a) Organizations eligible for the provisions of Article 11 of this Circular wishing to become the bidding members shall send the Finance Ministry to auction one (01) set of record specified in Clause 1 of this Article. The time limit for receiving records is from day 1 to 10 of November annually.

b) Within five (05) business days after receiving the records, the Ministry of Finance shall check the completeness and validity of the records and have a written notice to require additional document (if any) .

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

d) The list of selected organizations to be the bidding members takes effect from January 01 to December 31 annually and is announced on the website of the Ministry of Finance, the State Treasury and Hanoi stock Exchange.

1. Annually, the Ministry of Finance shall evaluate the bidding members’ activities as a basis for consideration and decision to maintain their bidding membership in the next year.

2. Process of evaluation of bidding members’ activities:

a) At least on November 10 annually, the bidding members shall send the Ministry of Finance the report on the activities of 12 months, from November 01 of the preceding year to October 31 of the current year (evaluation period), under the form prescribed in Annex 2 of this Circular, and information about the financial and business management situation and direction of activities for the next time.

b) Based on the bidding members’ obligations specified in Clause 2, Article 10 of this Circular, and members’ reports and the relevant information, the Ministry of Finance shall evaluate the members’ activities in the period of evaluation according to the criteria in Appendix 3 and announce the result of evaluation before December 31 annually. For the bidding members who do not meet the conditions for maintaining the bidding members, the Ministry of Finance shall have written notice, stating the reasons.

c) The bidding members’ evaluation result shall be announced on the website of the Ministry of Finance and the Hanoi Stock Exchange.

3. In order to prepare the bidding members’ activities annually, before May 15 annually, based on the monthly bidding members’ reports, the Ministry of Finance shall preliminarily notify of compliance with the members’ obligations within 06 months from November 01 of the preceding year to April 30 of the current year.

1. The Ministry of Finance shall cancel the bidding members’ membership in the following cases:

a) Revoked their business Licenses;

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

c) Business operations are specially controlled by the competent state authorities.

d) Having acts of violation of law by the conclusion of competent state authorities.

e) Making an application for not becoming the bidding members;

g) Failing to comply with regulations of law on the issuance of government bonds;

h) Failing to meet the conditions for further maintaining the bidding member as notified by the Ministry of Finance specified in Article 13 of this Circular.

2. The Ministry of Finance shall notify in writing to the organizations which are revoked their bidding membership and publish information on the website of the Ministry of Finance, the State Treasury and Hanoi Stock Exchange.

3. The members revoked their bidding membership as specified at Point e) and g), Clause 1 of this Article shall not be considered for approval to be the bidding members in two subsequent years.

1. Bond bidding is performed by one (01) of two (02) forms including:

a) Bid for competitive interest rate;

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

2. The result of bond bidding is determined by one (01) of two (02) methods

a) Single price bid ;

b) Multi-price bid.

3. The State Treasury shall announce the specific form of bid, method of determination of bidding results for each bond issuance bid

1. Keeping confidential all bidding information about the bidding members and information related to the interest rate of bid.

2. Publicly and equally performing the rights and obligations among bidding members in accordance with law.

3. In case the bid is held in the form of combination of competitive and non-competetive interest rate as specified at Point b, Clause 1, Article 15 of this Circular. The total volume of bonds issued to the bidding members of non-competitive intererest rate shall not exceed 30% of the total volume of bonds to be bid in an issuance session.

1. Within five (05) business days before the date of bond issuance organization, based on the proposal of the State Treasury, the Hanoi Stock Exchange shall send the notice of bond issuance to all bidding members and publish all information on the website of the Hanoi Stock Exchange

a) Volume and term of bonds planned to be issued, stating the bonds are first issued or additionally issued. In case of additional bonds to be issued, the notice must specify the conditions and terms of outstanding bonds;

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

c) Date of issuance organization, issuannce date, maturity date and payment date of bonds

d) Method of payment of interest and principal of bonds.

e) Form of bid

g) Method of determination of bidding result;

h) Account to receive money from buying bonds of State Treasury.

2. No later than 2 o’clock on the day of issuance organization, the bidding members shall send the Hanoi Stock Exchange the bidding information under the process and form of bidding registration prescribed by the Hanoi Stock Exchange. Each bidding member of competitive interest rate is allowed to place up to five (05) bidding level for each class of bond to be bid. Each bidding level includes the bidding interest rate (up to 2 decimal number) and the volume of corresponding bid bonds

3. The Hanoi Stock Exchange shall open the bids and sum up bidding information send it to the State Treasury.

4. Based on the general bidding information received from the Hanoi Stock Exchange, the State Treasury shall determine the issuance interest rate level for each class of bond to be bid and notify the Hanoi Stock Exchange in order to determine the bidding result specified in Article 18 of this Circular.

5. Upon the end of bond issuance session, the Hanoi Stock Exchange shall announce the bidding result to the State Treasury, Vietnam Securities Depository and each bid winning member as specifed in Annex 4 of this Circular and publish the bidding result on the website of the Hanoi Stock Exchange.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

a)Interest rate and volume of bonds to be bid;

b) Volume of bonds called for bid;

c) Interest rate frame of bond issuance specified in Article 5 of this Circular.

2. Method for determining bid-winning interest rate

a) For the method of single-price bid

The bid-winning interest rate is the highest interest rate level commonly applicable to all bidding members and is considered for selection in order from low to high of the interest rate for bid while satisfying two (02) conditions as follows:

- In the interest rate frame regulated by the Ministry of Finance;

- Volume of bonds cumulatively issued to the bid-winning interest rate level must not exceed the volume of bond called for bids.

b) For the method of multi-price bid

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

- The weighted average bid-wining interest rate levels shall not exceed the interest rate frame regulated by the Ministry of Finance.

- Volume of bonds cumulatively issued to the highest bid-winning interest rate level must not exceed the volume of bond called for bids.

3. In case at the highest bid-winning interest rate level, the volume of bid bonds cumulatively to the highest bid-winning interest rate exceeding the volume of bonds called for bids, after subtracting the volume of bid bonds at lower interest rate, the remainder of the volume of bonds called for bids shall be allocated to the bidding members at the highest bid-winning interest rate in proportion to the volume of bid bonds. The volume of bonds allocated to the members shall be rounded down to the nearest unit.

4. Determining the bid-winning result for the bonds called for bids in the form of non-competitive interest rate.

a) The interest rate of bond issuance for the bonds called for bids in the form of non-competitive interest rate is the highest bid-winning interest rate (for the method of single-price bid) or the weighted average of the bid-winning interest rate level (for multi-price bid), and is rounded up to 02 decimal places.

In case all bidding members of competitive interest rate do not win the bid, the bonds shall not be issued to the bidding members of non- competitive interest rate.

b) The volume of bonds issued to each bidding member of non- competitive interest rate is equivalent to the volume of bid bonds of that member. In case the total bid volume exceeds the limit specified in Clause 3, Article 16 of this Circular, the volume of bonds issued to each bidding member of non-competitive interest rate shall be allocated in proportion to the volume of bid bonds of that member.

5. Determining the selling price of bonds

a) For bonds initially issued:

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

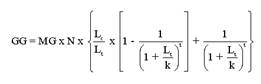

In which:

GG = Amount of money from bond purchase

N = Volume of bonds issued to the bid-winning member

MG = Face value of bond

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

T = Number of times to pay interest between the date of bond issuance and the maturity date of bond.

k = Number of times to pay interest in a year

Lt = Interest rate of bond issuance for the bondholders (%/year)

- In case the date of bond issuance is a day of rest or a holiday as prescribed (thus the date of bond payment is the succeeding business day of the date of bond issuance), the amount of money from bond purchase is determined as follows:

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

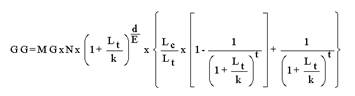

GG = Amount of money from bond purchase

MG = Face value of bond

N = Volume of bonds issued to the bondholders

Lc = Nominal interest rate of bonds (%/year) is the weighted average of interest rate levels of bond issuance for bid-winning members and rounded to 01 decimal number as specified in the Annex 5 of this Circular

k = Number of times to pay interest in a year

d = Actual number of days between the date of bond issuance and the date of bond payment of the investors

E = Actual number of days in the first interest payment term of bonds

t = Actual remaining times of payment between the date of bond payment and maturity date of the bonds

Lt = Interest rate of bond issuance for the bondholders (%/year)

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

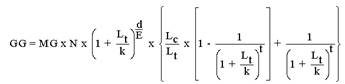

- n case the date of bond payment is the cum right date, the amount of money from bond purchase is determined as follows:

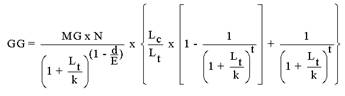

- In case the date of bond payment is the ex-right date, the amount of money from bond purchase is determined as follows:

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

In which:

GG = Amount of money from bond purchase

MG = Face value of bond

N = Volume of bonds issued to the bondholders

Lc = Nominal interest rate of outstanding bonds (%/year) and is additionally issued

K = Number of times to pay interest in a year

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

E = Actual number of days in the interest payment term in which the bonds are additionally issued

T = Actual times of interest payment between the date of bond payment and maturity date of the bonds

Lt = Interest rate of bond issuance

(%/year)

Article 19. Principle to organize bond underwriting

1. The bond underwriting is organized in the form of book record with the participation of one or many underwriting organizations (consortium underwriting).

2. The State Treasury shall select the main underwriting organization to represent the consortium underwriting to conduct negotiation and reach an agreement upon the volume, term, interest rate and underwriting fee for each bond issuance under the provisions of this Circular.

3. The class of bond issued by the method of underwriting is the bonds with the terms of 5 years or more as prescribed by the Ministry of Finance.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

1. Rights

a) Being the unique legal representative of the rights and obligations of the consortium underwriting to conduct negotiation and reach an agreement with the State Treasury upon the bond underwriting.

b) Being entitled to distribution of bonds of the bond underwriting under the underwriting contract signed with the State Treasury.

c) Being entitled to the underwriting fee on the basis of negotiation and consensus with the State Treasury as prescribed in this Circular.

d) Having the right to select members of the consortium underwriting and making a decision on the rate of underwriting fee paid to these members.

2. Obligations

a) Having responsibility to distribute all volume of bonds in a period of time specified in the underwriting contract signed with the State Treasury. In case the volume of bonds are not distributed all to the investors, the main underwriting organization shall buy the whole remaining volume of bonds.

b) Having responsibility to receive the bond payment of the members of consortium underwriting and paying in due time the bond payment under the contract signed with the State Treasury and provisions in this Circular.

c) Fully implementing other obligaitons specified in the principle contract and underwriting contract signed with the State Treasury.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

1. Being commercial banks and securities companies that are established and operating legally in Vietnam and are allowed to provide the securities guarantee services under the regulations of relevant laws.

2. Having charter capital actually contributed at least equal to the legal capital as prescribed by the relevant laws.

3. Meeting the capital adequacy ratio as prescribed by law.

4. Having an operating time of at least three (03) years.

5. Having experience in the area of secutiries guarantee particularly implementing at leat one (01) contract of bond underwriting.

6. Making an application for becoming the main underwriting organization.

Article 22. Process of selection of main underwriting organization and consortium underwriting

1. At least 30 business days before the date of organization of underwriting session, the State Treasury shall announce on the website of the Ministry of Finance, the State Treasury and the Hanoi Stock Exchange the plan for organization of bond underwriting and invitation for participation registration as the main underwriting organization.The contents of the announcement includes

a Information on bonds planned to be issued:

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

- Volume of bonds to be issued.

b) Information on selection of main underwriting organization:

- Conditions and standards for the main underwriting organization are specified in Article 21 of this Circular.

- Time limit, address, form and method of receiving registration application to become the main underwriting organization.

2. Organizations meeting the conditions and wishing to become the main underwriting organization shall send the registration record in accordance with regulation in the notice of the State Treasury. The registration record includes:

a) The registration application to become the main underwriting organization is under the form regulated by the State Treasury.

b) Proposal for the bond underwriting plan with the basic contents as follows:

- Introductory information about the organization: business lines, financial condition, capacity and operational experience in the field of securities underwriting and participation in the bond market;

- Analysis, comments and forecasts on the situation of bond market and the possibility of bond issuance by the method of underwriting;

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

- Commitments of the main underwriting organization

c) Documents evidencing the eligibility for becoming the main underwriting organization including:

- Copy of notarized business License;

- Audited financial statements of the last three (03) years;

- Documents and materials evidencing the satisfaction of the capital adequacy ratio as prescribed by law;

- Documents evidencing the operations of the organization in the field of securities guarantee particularly bond underwriting.

3. Within five (05) business days after the end date of receipt of application for becoming the main underwriting organization, the State Treasury shall evaluate and select a main underwriting organization based on the following grounds:

a) Criteria and conditions of the main underwriting organization as stipulated in Article 21 of this Circular.

b) Capacity, experience and capacity to assume the role of main underwriting over the bond issuance at the proposal of the organization specified at Point b, Clause 2 of this Article.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

5. The State Treasury and the main underwriting organization shall agree upon the content and sign the principle contract to implement the bond underwriting under the form of contract specified in the Annex 6 of this Circular.

6. Based on the principle contract signed with the State Treasury, the main underwriting organization shall select the members of consortium underwriting that are organizations and individuals established and operating or legally residing in Vietnam and permitted for investment in buying Government bond as prescribed by law including Vietnam Social Insurance.

1. Within 10 business days after signing the principle contract with the State Treasury, the main underwriting organization shall send the State Treasury a written notification of the list of the consortium underwriting members participating in the bond underwriting under the form specified in Section 1, Annex 7 of this Circular and Agreement of the consortium underwriting signed by underwriting members under the form in Section 1, Annex 7 of this Circular.

2. On the basis of the written notification of the main underwriting organization, based on interest rate frame and the underwriting fee regulated by the Ministry of Finance, the State Treasury and the main underwriting organization shall conduct negotiation on the volume, terms and conditions of the bonds ( term, interest rate of issuance, date of issuance, date of bond payment, selling price of bonds), underwriting fee determined on the principles specified in Article 18 of this Circular.

3. Based on the result of negotiation, the State Treasury shall sign contract of bond underwriting with the main underwriting organization under the form of contract specified in Section 3, Annex 7 of this Circular. The contract of bond underwriting is the legal ground to determine the rights and obligations of the main underwriting organization and the rights and obligations of the State Treasury as specified in this Circular.

4. No later than the date following the date to sign the contract of bond underwriting, the State Treasury shall notify the result of underwriting to Vietnam Securities Depository and Hanoi Stock Exchange to perform the procedures for registration and depository and listing of the bonds while publishing the result of underwriting on the website of the Ministry of Finance, the State Treasury and the Hanoi Stock Exchange.

Article 24. Principle of bond issuance by the agent method

1. The State Treasury shall select eligible organizations specified in this Circular to be the issuing agent and bond interest and principal paying agent.

2. The State Treasury shall make the bond issuance plan by the agent method and make a report to the Ministry of Finance for approval before implementation.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

1. Being commercial banks and securities companies established and operating legally in Vietnam;

2. Having contributed charter capital at least equal to the legal capital of the relevant laws.

3. Having the time of operation of at least 03 years;

4. Meeting the capital adequacy ratio in accordance with the relevant laws;

5. Having an operation network to ensure the bond issuance at the request of the State Treasury for each issuance

6. Making an application for becoming a bond issuing agent

Article 26. Process of selection and signing of bond issuing agent contract

1. At least 30 business days prior to the date of bond issuance organization by the method of issuing agent, the State Treasury shall announce on the website of the Ministry of Finance, the State Treasury and Hanoi Stock Exchange the plan for bond issuance and invitation to register as an issuing agent. The contents of the announcement includes:

a) Information on bonds planned for issuance:

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

- Volume of bonds to be issued.

b) Information on the selection of issuing agent:

- Form of agent: Issuing agent or bond issuing and paying agent;

- Conditions and criteria for agents are prescribed in Article 25 of this Circular;

- Form, time limit, place and method of receiving registration application for becoming bond issuing agent.

2. Organizations meeting the conditions specified in Article 25 of this Circular and wishing to be an agent shall send registration records to the State Treasury in accordance with the annoucement specified in Article 1. The registration record includes:

a) Registration application for being an agent under the form specified in Section 1, Annex 8 of this Circular.

b) Making a proposal for the bond issuance organization plan with the following basic contents:

- Introductory information about the organization: business lines, financial condition, capacity and operational experience in the field of securities distribution and participation in the bond market;

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

- Implementation plan for the bond issuance by the agent method;

- Proposed fee for bond issuing agent and bond paying agent.

b) Documents evidencing the eligibility for becoming a bond issuing agent including:

- Copy of notarized business License;

- Audited financial statements of the last three (03) years;

- Documents and materials evidencing the satisfaction of the capital adequacy ratio as prescribed by law;

3. Within 05 business days after the end date of receipt of application for being a bond issuing agent, the State Treasury shall consider, evaluate and select one or several agents based on the following grounds:

a) The conditions and criteria of a bond issuing agent as specified in Article 25 of this Circular;

b) The capacity and ability to perform the function of an issuing agent of the registering organization;

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

4. The State Treasury shall notify in writing the registering organizations of the result of selection of bond issuing agent and publish information on the website of the Ministry of Finance, the State Treasury and Hanoi Stock Exchange.

5. The State Treasury shall conduct negotiation and sign contract with the bond issuing agent under the form of agent contract specified in Section 2, Annex 8 of this Circular.

1. The agent shall organize the bond issuance under the terms and conditions of bonds specified in the contract the agent has signed with the State Treasury.

2. Within 30 business days after the end date of bond issuance by the agent method, the State Treasury shall make a report to the Ministry of Finance on the issuance result.

SECTION 4. RETAILING BONDS THROUGH THE STATE TREASURY SYSTEM

Article 28. Principle of bond issuance.

1. The bond issuance by the retailing method is used to issue bonds directly to investors that are organizations and individuals in the country and abroad including Vietnam Social Insurance.

2. The State Treasury shall carry out the issuance and payment of interest and principal of bonds through its branch system nation-wide.

3. The State Treasury shall make a bond issuance plan by the retailing method specified in Clause 1 of this Article and make a report to the Ministry of Finance for approval before implementation.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

Article 29. Process and procedures for bond issuance

1. At least 20 business days before the bond issuance by the retailing method, the State Treasury shall announce in detail the issuance on on the website of the Ministry of Finance, the State Treasury and Hanoi Stock Exchange and mass media. The content of the announcement includes:

a) Volume and term of the bonds planned for issuance;

b) Nominal interest rate of the bonds;

c) Form of the bonds;

d) Form of payment of interest and principal of bonds;

e) Time and location of issuance organization.

2. The State Treasury shall guide in detail the process and procedures for the bond issuance and payment by the retailing method and make a report to the Ministry of Finance for approval before promulgation and implementation

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

1. For bonds issued by the method of bid and underwriting as specified in Section 1 and 2, Chapter III of this Circular, no later than 2 o’clock PM of the date of bond payment notified by the State Treasury, the bid-winning members (for bidding method), the main underwriting organization (for underwriting method) must guarantee the total amount of money used to buy bonds have been paid and credited into the account designatedby the State Treasury. The bid-winning members or the main underwriting organization must record sufficient information on money order on the requirement of the State Treasury

2. For bonds issued by the agent method, based on the time regulated in the agent contract and the volume of bonds to be issued, in the date of issuance, the agent shall transfer the money from bond selling to the accounts designated by the State Treasury.

3. For bonds issued by the retailing method through the State Treasury system, the money from bond purchase may be paid in the forms as follows:

a) Paid in cash immediately right after the bond purchase at the location of bond issuance announced by the State Treasury;

b) Paid by bank transfer to the account designated by the State Treasury at the place of bond issuance.

1. In case of late transfer of money to the State Treasury as prescribed, the organization responsible for payment of bonds under the provisions of this Circular and the contracts signed with the State Treasury shall pay fines for late payment . The fine for late payment is determined by the following formula:

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

P = Fine for late payment

MG = Face value of bond

N = Volume of bonds issued but late paid

Lc = Nominal interest rate of bonds (%/year)

k = Number of times to pay interest in a year

n = Actual number of days of late payment from the payment date.

E = Actual number of days of an interest payment term that the delay in payment arising

2. For the bonds issued by the method of bid and underwriting, within five (05) business days after the date of bond payment, if the bid-winning member/main underwriting organization does not make payment of bonds, the State Treasury shall cancel the issuance result for the volume of bonds not being paid and send a written notification to the bid-winning member/main underwriting organization, the Hanoi Stock Exchange and Vietnam Securities Depository.

REGISTRATION, DEPOSITORY AND LISTING OF BONDS

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

1. The bonds issued by the method of bid and underwriting are registered and deposited at Vietnam Securities Depository.

2. Based on the written notification of the result of bond issuance of the State Treasury and Hanoi Stock Exchange, the Vietnam Securities Depository shall perform the registration of issued bonds. The time for bond registration is no later than the day following the date of bond payment.

3. The Vietnam Securities Depository shall perform the bond depository in the accounts of the owners after receiving the State Treasury’s written confirmation of complete payment for bonds.

4. The cancellation of registration of bonds whose payment has not been made shall be done by the Vietnam Securities Depository based on the State Treasury’s written notification of cancellation of result of bond issuance.

Article 33. Listing and trading of bonds

1. The bonds issued by the method of bid and underwriting shall be listed and traded concentratedly on Hanoi Stock Exchange.

2. The Hanoi Stock Exchange shall list the bonds based on the Vietnam Securities Depository’s written notification of bond registration. The bonds shall be listed no later than the 2nd business day after the date of bond payment.

3. The bonds after being listed shall be traded no later than the 3rd business day after the date of bond payment.

4. The cancellation of listing of bonds whose payment has not been made shall be done by the Hanoi Stock Exchange based on the State Treasury’s written notification of cancellation of result of bond issuance and the Vietnam Securities Depository’s written notification of cancellation of listing of bonds whose payment has not been made.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

1. The central budget shall ensure the payment of interest and principal of bonds upon maturity date. In case the date of payment of interest and principal is a day of rest or holiday as prescribed, the interest and principal shall be paid on the succeeding business day.

2. Process of payment of interest and principal of bonds issued by the method of bid and underwriting.

a) No later than the 25th date of every month, the Vietnam Securities Depository shall notify the State Treasury the bond interest and principal to be paid in the following month and the payment date.

b) No later than 11 o’clock AM of the date of interest and principal payment, the State Treasury shall ensure the total interest and principal payment in the payment date shall be transferred and credited into the accounts announced by the Vietnam Securities Depository.

c) On the date of interest and principal payment, the Vietnam Securities Depository, through its depository members, shall transfer the interest and principal payment to the bondholders identified on last registration day.

d) In case the State Treasury transfers the interest and principal payment to the Vietnam Securities Depository’s informing account later than specified at Point b, Clause 2 of this Article, the State Treasury shall be subject to the fine for late payment. This fine shall be allocated by the Vietnam Securities Depository in order to transfer it to the account of the bondholders in proportion to the bonds owned. The fine for late payment shall be determined by the principle specified in Article 31 of this Circular.

e) In case the State Treasury has transferred the interest and principal payment of the bonds to the Vietnam Securities Depository’s informing account at the time prescribed at Point b, Clause 2 of this Article but the Vietnam Securities Depository has transferred the interest and principal payment to the bondholder’s account after the date of interest and principal payment, the Vietnam Securities Depository shall bear a fine for late payment to the bondholder. The fine for late payment is determined by the principle specified in Article 31 of this Circular.

3. The interest and principal payment of the bonds issued by the agent method is carried out under the agent contract between the State Treasury and agent organization.

4. The interest and principal payment of the bonds issued by the retailing method through the State Treasury system under the guidance of the State Treasury.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

1. The central budget shall ensure the payment for the fee of issuance organization, interest and capital payment of bonds and fee of bond certificate printing.

2. Fee of issuance organization and interest and principal payment of bonds issued by the method of bid and underwriting shall be paid to the following organizations:

a) 0.07% of the nominal value of bonds issued by the bidding method shall be paid to the Hanoi Stock Exchange.

b) Fee of underwriting is paid to the main underwriting organization under the agreement between the State Treasury and the main underwriting organization but does not exceed 0.15% of the nominal value of distribution bond.

c) 0.04% of the value of actually paid interest and principal of bonds is paid to the Vietnam Securities Depository;

d) 0.01% of the nominal value of the issued bond is paid to the State Treasury.

3. Fee of issuance organization and interest and principal payment for the bonds issued by the method of retailing method is paid to the State Treasury at the maximum rate of 0.10% of the total nominal value of the bonds successfuly issued, excluding fee of certificate printing (if any).

4. Fee of issuance organization and interest and principal payment for the bonds issued by the agent method is paid to the issuing agent at the maximum rate of 0.10% on the total nominal value of the bonds successfuly issued, excluding fee of certificate printing (if any).

5. Use of source of fee of bond issuance, interest and principal payment

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

- Fees for bond issuance through the State Treasury system (for the case of issuance by the retailing method);

- Fees for procurement and building of software technology and equipment for bond issuance;

- Fees for periodic maintenance and upgrade, irregular repair of machinery, equipment and software.

- Fees for advertising information on the issuance;

- Direct fees for each bidding and underwriting sessions;

- Fees for study of bond market development

- Fees for organization of conference, seminar and experiential learning of Government bond market development;

- Fees for annual customer conference to sum up the bond issuance;

- Fees for irregular and periodic bonus to organizations and individuals related to the bond issuance under the regulations promulgated by the State Treasury after the Ministry of Finance’s approval.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

- Other fees for bond issuance.

b) Fees of bond bidding is the revenue of the Stock Exchange and the fees for interest and principal payment is the revenue of the Vietnam Securities Depository. The Hanoi Stock Exchange and Vietnam Securities Depository shall manage and use of these fees in accordance with the enterprises’ financial mechanism of as prescribed by relevant laws.

ACCOUNTING RECORD, REPORTING AND INFORMATION PUBLICATION

The State Treasury, Hanoi Stock Exchange and Vietnam Securities Depository and the relevant organization are responsible for the accounting record of revenue from bond issuance, interest and principal payment and fees of issuance, interest and principal payment of bonds specified in this Circular in accordance with the Law on State Budget, Accounting Law and the relevant guiding documents.

1. For bonds issued by the method of bid and underwriting, within 5 business days after the end of bond issuance session, the State Treasury shall make a report to the Ministry of Finance on the issuance result, particularly:

a) Volume, terms and conditions of the bonds announced to be issued;

b) Situation of bidding and underwriting of the members: the number of participants, volume, registered interest rate of each member;

c) Issuance result: bid-winning members, volume of issuance, interest rate of issuance and bond selling price.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

a) Volume, terms and conditions of the bonds announced to be issued;

b) The result of the issuance session: selected agent, volume, interest rate of bond issuance and situation of payment of agent fees and issuance fees.

Article 38. Report on the issuance, interest and principal payment of bond

1. No later than the 25th date of each month, the State Treasury shall make a report to the Ministry of Finance on the situation of issuance and payment of bond of the previous month and the planned bond issuance of the following month, particularly:

a) Total volume of bonds issued in a month by term and method of issuance

b) Total volume of bond interest and principal to be paid in the reporting month;

c) Total volume of bond interest and principal planned for payment in the following month;

d) Expected volume of bonds issued in a month by term and method of issuance.

2. The Vietnam Securities Depository shall make a quarterly report to the Ministry of Finance on the situation of bond ownership of the foreign investors and situation of bonds involved in the mortgage and pledge on the currency market under the form specified in the Annex 9 of this Circular.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

a) Code of bonds whose interest and principal shall be paid in the year;

b) Date of interest and principal payment of each code of bond.

c) The last registration date in the year of each code of bond.

2. For bonds issued by the retialing method, before December 31 of each year, the State Treasury shall coordinate with the Hanoi Stock Exchange to publish information on interest and principal payment in the following year on the website of the Hanoi Stock Exchange.

Article 40. Responsibilities of the State Treasury

1. Organizing the issuance, payment of interest and principal, payment of issuance and agent fees and fees of payment of interest and principal as prescribed in this Circular.

2. Developing regulations on bond issuance and payment by the retailing method through the State Treasury system and making a report to the Ministry of Finance for approval before implementation.

3. Signing principle contract and underwriting contract and ensuring that the main underwriting organization shall comply with the provisions in the contract and this Circular.

4. Fully complying with the reporting and accounting record regime concerning the bond issuance as prescribed in this Circular.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

Article 41. Responsibilities of Hanoi Stock Exchange

1. Developing regulations on bond issuance bidding, publication of selling and buying price of bonds applicable to the bidding members and making a report to the Ministry of Finance before implementation.

2. Organizing the bond issuance bidding as prescribed in this Circular.

3. Providing necessary data and documents related to the activities of bond issuance bidding as prescribed in this Circular and/or on the requirement of the Ministry of Finance.

4. Storing and preserving information related to the bond issuance bidding as prescribed.

5. Coordinating with the State Treasury and Stock Exchange to publish information as prescribed in this Circular.

6. Listing or delisting bonds under the provisions of this Circular.

Article 42. Responsibilities of Vietnam Securities Depository

1. Performing the registration and depository or cancelling registration and depository as prescribed in this Circular.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

3. On the 25th date of each month periodically, providing the State Treasury the codes to be supplied to the bonds initially issued in order to notify to the bidding members and publish on the website of the Hanoi Stock Exchange as prescribed in this Circular.

4. Providing necessary data and documents related to the field of management as prescribed in this Circular and/or on the requirement of the Ministry of Finance.

Article 43. Transitional provision

1. The bidding members recognized by the Hanoi Stock Exchange as prescribed in the Circular No. 21/2004/TT-BTC, the guarantee members and agent of bond issuance recognized by the Ministry of Finance as prescribed in the Circular No.29/2004/TT-BTC and the bidding members of treasury bills recognized by the State Bank as prescribed in the Circular No.19/2004/TT-BTC shall participate in the bidding sessions of treasury bills and Government bonds until the Ministry of Finance has the notification of registration of selection of bidding members as specified in Chapter II of this Circular.

2. The Ministry of Finance shall announce the specific time to receive the registration records of bidding members and the time to evaluate the activities of the bidding members applicable for the year 2012 and 2013.

1. This Circular takes effect on March 26, 2012.

2. This Circular supersedes the following guiding documents:

a) The contents guiding the issuance of Government bonds specified in the Decision No. 66/2004/QD-BTC dated August 11, 2004 of the Minister of Finance promulgating the regulations on the order and procedures for the issuance of Government bonds, Government-guaranteed bonds and local government bonds.

b) The contents guiding the issuance of Government bonds specified in the Circular No. 21/2004/TT-BTC dated March 24, 2004 of the Ministry of Finance guiding the bidding of Government bonds, Government-guaranteed bonds and local government bonds through the concentrated securities trading market.

...

...

...

Mọi chi tiết xin liên hệ: ĐT: (028) 3930 3279 DĐ: 0906 22 99 66

d) The Decision No. 46/2006/QD-BTC dated September 6, 2006 of the Minister of Finance promulgating regulations on issuance of Government bonds in large batches;

e) The Circular No.132/2010/TT-BTC dated September 7, 2010 guiding the amendment and supplementation of the Decision No. 46/2006/QD-BTC dated September 6, 2006 by the Minister of Finance promulgating regulations on issuance of Government bonds in large batches;

g) The contents guiding the fees of bidding of Government bonds, agent of interest and capital payment of Government bonds specified in the Circular No. 27/2010/TT-BTC dated February 26, 2010 regulating the rate and regulation on collection, remittance, management and use of fees of secutiries activities applicable at Stock Exchanges Vietnam Securities Depository.

1. Chief of Office, Director of Financial Department of banks and financial institutions, General Director of State Treasury and Heads of units concerned are liable to execute this Circular.

2. Any difficulties arising during the implementation should be promptly reported to the Ministry of Finance for consideration and specific guidance.

FOR THE MINISTER

DEPUTY MINISTER

Tran Xuan Ha

...

...

...

- 1 Circular No. 21/2004/TT-BTC of the Ministry of Finance,

- 2 Circular No. 29/2004/TT-BTC of April 6, 2004 guiding the issuance under-writing and issuance agency for Government bonds, Government-underwritten bonds and local administrations' bonds

- 3 Decision No. 66/2004/QD-BTC of August 11, 2004, promulgating the guiding regulation on order and procedures for issuing Government Bonds, Government-underwritten Bonds and Local Administrations’ Bonds.

- 4 Circular No. 27/2010/TT-BTC of February 26, 2010, prescribing rates and the collection, remittance, management and use of charges for securities operations to be applied at the Stock exchanges and the Vietnam Securities Depository Center

- 5 Circular No. 111/2015/TT-BTC dated July 28, 2015,

- 6 Circular No. 111/2015/TT-BTC dated July 28, 2015,

- 1 Circular No. 99/2015/TT-BTC dated June 29, 2015,

- 2 Decree No. 01/2011/ND-CP of January 05, 2011, on issuance of government bond, government-guaranteed bonds and local government bonds

- 3 Law No. 62/2010/QH12 of November 24, 2010, amending, supplementing a number of articles of Law on Securities

- 4 Law No. 29/2009/QH12 of June 17, 2009, on public debt management

- 5 Decree No. 118/2008/ND-CP of November 27, 2008, defining the functions, tasks, powers and organizational structure of the Ministry of Finance.

- 6 Law No.70/2006/QH11 of June 29, 2006 on securities

- 7 Circular No.19/2004/TT-BTC of March 18th, 2004 guiding the treasury bill and foreign-currency bond bidding through Vietnam State Bank

- 8 Law No. 03/2003/QH11 of June 17, 2003, on accounting

- 9 Law No.01/2002/QH11 of December 16, 2002 state budget Law

Tiếng Việt

Tiếng Việt